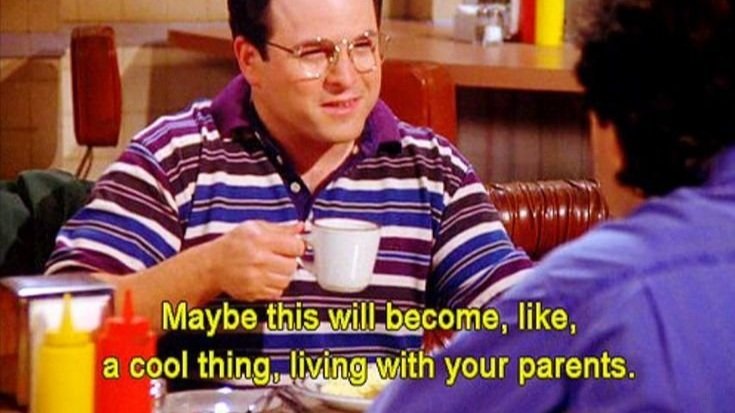

1 in 3 Young Adults Still Live with Their Parents: A Growing Trend and Its Impact

As housing costs continue to rise and economic pressures mount, it’s no surprise that 1 in 3 young adults in the U.S., aged 18 to 34, are still living with their parents. This trend, reported by CNBC, is fueled by rising living costs, economic uncertainties, and the challenges Millennials and Gen Z face in achieving financial independence. For many, the decision to stay home is driven by necessity, not comfort. High housing costs, student debt, stagnant wages, and economic shocks have made independent living unaffordable for many young adults, forcing them to delay milestones like moving out, buying a home, or starting families.

Financial Challenges Driving the Trend

In today’s economy, Millennials and Gen Z face unique financial challenges. With inflation pushing up everyday costs, it's harder to make ends meet. Add student loans to the mix, and it’s clear why so many young adults opt to live with their parents longer. For example, Victoria Franklin saves up to 50% of her income by living at home, a strategy many young adults are adopting to build savings and pay down debt. This setup allows them to focus on career advancement and future goals, though it often means postponing life events like purchasing a home.

Living at home also has broader economic implications. According to reports, young adults living with their parents contribute $13,000 less annually to the economy in consumer spending. This missing spending affects everything from home goods to dining and travel. For young adults, staying at home may provide financial relief, but it also delays major purchases, such as buying a home. As more young adults save for down payments, they push homeownership further into the future, slowing housing market activity and affecting real estate investments.

Housing Market Implications

For homebuyers, this delay in homeownership presents both challenges and opportunities. As Millennials and Gen Z eventually enter the housing market, demand for more affordable homes may rise. Yet with higher home prices and mortgage rates, they will face additional hurdles to purchasing homes. This shift in demographics could reshape the housing market, as these generations look for smaller, more affordable options to break free from living with parents.

Need Help Looking For A House in OKC?

If you’re a first-time homebuyer or navigating the housing market after years of saving, the Justiz League Real Estate Team is here to guide you through the process. With expert knowledge of local markets and a passion for helping clients achieve their real estate goals, we are ready to support your journey to homeownership.

For more insights into the economic trends affecting homeownership, check out the full article on CNBC.