Where Home Prices Are Headed, According to Zillow's Latest Forecast

As we end 2024, many potential homebuyers, sellers, and investors are curious about the direction of home prices. According to Zillow’s latest forecast, U.S. home prices are expected to rise by 2.9% over the next 12 months, from October 2024 to October 2025. This forecast offers key insights into how the housing market will evolve and provides important information for anyone involved in real estate.

What Zillow’s Forecast Means for Homebuyers

For homebuyers, the projected 2.9% increase in home prices means that while the rapid acceleration in home values of the past few years may slow down, prices will still continue to climb at a moderate pace. This suggests that waiting for a significant dip in home prices may not be the best strategy if you're planning to buy in the next year.

However, the slower pace of growth offers an opportunity for homebuyers to enter the market without the extreme competition and bidding wars that characterized the housing boom. Buyers may have more time to consider their options, and with lower price increases, purchasing power may stabilize in many areas.

If you're considering buying, it may be wise to act sooner rather than later to lock in a home before prices rise further.

Why Are Home Prices Expected to Rise?

Several factors contribute to this moderate increase in home prices:

Continued Low Inventory: The supply of homes on the market remains constrained, which continues to put upward pressure on prices. While new construction is picking up in some areas, housing inventory still lags behind demand in many regions.

Stable Demand: Despite higher mortgage rates, demand for homes remains strong, especially in desirable areas and for single-family homes. Many buyers are still looking to take advantage of relatively stable prices and are willing to move forward with purchases.

Economic Conditions: The overall economic environment—while slower—remains favorable for real estate, with steady job growth and wage increases helping to support homebuyer demand.

Looking Ahead: A Steady, Moderate Growth in Home Prices

Zillow's forecast of a 2.9% increase in U.S. home prices over the next year suggests that the housing market will continue to grow, albeit at a more stable pace. For homebuyers, sellers, and investors, this presents a unique opportunity to make informed decisions and act strategically within a more predictable market.

Whether you’re looking to purchase your first home, sell your property, or invest in real estate, understanding where home prices are headed will help you make the right moves in the market.

Need Help Navigating the Market?

If you're looking to buy, sell, or invest in real estate, the Justiz League Real Estate Team is here to guide you through every step of the process. Our team offers expert insights and personalized advice to help you make informed decisions in the evolving market.

For more information, visit the full article here.

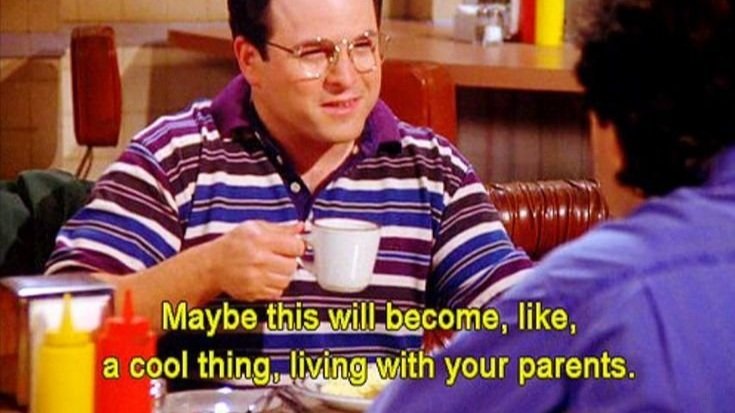

1 in 3 Young Adults Still Live with Their Parents: A Growing Trend and Its Impact

As housing costs continue to rise and economic pressures mount, it’s no surprise that 1 in 3 young adults in the U.S., aged 18 to 34, are still living with their parents. This trend, reported by CNBC, is fueled by rising living costs, economic uncertainties, and the challenges Millennials and Gen Z face in achieving financial independence. For many, the decision to stay home is driven by necessity, not comfort. High housing costs, student debt, stagnant wages, and economic shocks have made independent living unaffordable for many young adults, forcing them to delay milestones like moving out, buying a home, or starting families.

Financial Challenges Driving the Trend

In today’s economy, Millennials and Gen Z face unique financial challenges. With inflation pushing up everyday costs, it's harder to make ends meet. Add student loans to the mix, and it’s clear why so many young adults opt to live with their parents longer. For example, Victoria Franklin saves up to 50% of her income by living at home, a strategy many young adults are adopting to build savings and pay down debt. This setup allows them to focus on career advancement and future goals, though it often means postponing life events like purchasing a home.

Living at home also has broader economic implications. According to reports, young adults living with their parents contribute $13,000 less annually to the economy in consumer spending. This missing spending affects everything from home goods to dining and travel. For young adults, staying at home may provide financial relief, but it also delays major purchases, such as buying a home. As more young adults save for down payments, they push homeownership further into the future, slowing housing market activity and affecting real estate investments.

Housing Market Implications

For homebuyers, this delay in homeownership presents both challenges and opportunities. As Millennials and Gen Z eventually enter the housing market, demand for more affordable homes may rise. Yet with higher home prices and mortgage rates, they will face additional hurdles to purchasing homes. This shift in demographics could reshape the housing market, as these generations look for smaller, more affordable options to break free from living with parents.

Need Help Looking For A House in OKC?

If you’re a first-time homebuyer or navigating the housing market after years of saving, the Justiz League Real Estate Team is here to guide you through the process. With expert knowledge of local markets and a passion for helping clients achieve their real estate goals, we are ready to support your journey to homeownership.

For more insights into the economic trends affecting homeownership, check out the full article on CNBC.

Apartment Builders Pull Back While Single-Family Homebuilders Hold Steady: What This Means for the Market

The housing market is seeing a significant trend: apartment builders are scaling back construction, while single-family homebuilders remain resilient. This shift in building patterns has implications for homebuyers, sellers, and investors alike, signaling a shift in supply and demand dynamics.

Why Apartment Builders Are Pulling Back

Rising construction costs, changes in consumer demand, and higher interest rates have led apartment developers to pull back on new projects. High inflation and the ongoing challenge of rising construction material prices have made large-scale apartment projects less financially viable in many regions. Additionally, higher mortgage rates have reduced the demand for rental units in some areas, causing builders to reassess their strategies.

Single-Family Homebuilders Stay Steady

Meanwhile, single-family homebuilders are holding steady, continuing to build homes in response to ongoing demand. Despite the challenges of a higher interest rate environment, many buyers are still eager to purchase homes, particularly in suburban and rural areas where affordability is more attainable. The continued strength of single-family homebuilding reflects the shift in preferences toward more spacious, private living environments—especially for families.

What Does This Mean for Homebuyers and Investors?

For homebuyers, particularly first-time buyers, the reduced pace of apartment construction could mean fewer rental options in the coming years, potentially leading to higher rents. For those looking to purchase homes, the steady pace of single-family construction offers opportunities, especially in markets where supply is still lagging behind demand.

For investors, this divergence creates opportunities in both sectors. Those investing in single-family homes may benefit from long-term growth as demand remains strong, while apartment investors may face challenges with fewer new developments hitting the market, driving up competition for existing rental properties.

Looking Forward

The landscape of housing development is changing, with apartment builders pulling back and single-family homebuilders staying the course. This shift will play a significant role in shaping the market in the coming years, presenting both challenges and opportunities for homebuyers, sellers, and investors.

Need Expert Guidance?

Whether you’re buying your first home, selling a property, or looking to invest in real estate, the Justiz League Real Estate Team is here to help. Our team of experienced professionals offers expert advice tailored to your unique real estate needs.

For more insights into this trend, check out the full article on RESI Club Analytics.

Surge in Housing Markets: 54 of the Top 200 Now Exceed Pre-Pandemic Inventory Levels, Up from Just 17 Last Year

The housing market is experiencing a significant shift, with inventory levels now exceeding pre-pandemic numbers in 54 of the nation's top 200 housing markets. Just last year, only 17 markets had reached this milestone. This surge in available homes presents both challenges and opportunities for homebuyers, sellers, and investors alike.

What This Surge Means for Homebuyers

For potential homebuyers, the increase in housing inventory is a welcome sign. After years of tight supply and escalating prices, this new influx of available homes provides more options and potentially better pricing. While some markets may still face affordability challenges, the rise in inventory signals a shift toward more balanced conditions in many regions.

Opportunities for Sellers

Sellers can take advantage of this surge in inventory by pricing their homes strategically. With more competition in the market, it’s important to ensure your property stands out. Homes that are well-maintained, priced competitively, and marketed effectively can still generate strong interest, especially in markets where demand remains high.

Investment Opportunities for Investors

For real estate investors, the increased inventory presents several opportunities. More homes on the market mean more options for buying and flipping properties, expanding rental portfolios, or even entering markets previously too competitive. Investors can also benefit from the stabilizing effect of a more balanced market, reducing the risk of overpaying for properties in an overheated market.

Looking Ahead

As we head into 2025, the increased housing inventory is a game-changer. Whether you're a first-time buyer, a seasoned seller, or a savvy investor, this shift offers new possibilities in what has been a challenging real estate environment. While the market is far from predictable, the surge in available homes is a positive development for many stakeholders.

Need Help Navigating the Market?

Whether you’re a first-time homebuyer, looking to sell, or interested in investing, the Justiz League Real Estate Team is here to guide you every step of the way. With deep knowledge of local markets, we’ll help you make informed, strategic decisions.

For more insights on the housing market shift, visit RESI Club Analytics.

Why First-Time Homebuyers Are Key to the 2025 Housing Market

As we look toward the 2025 housing market, first-time homebuyers will play a crucial role. They represent nearly 40% of all buyers and are integral to maintaining market fluidity. Their decisions ripple through the market, freeing up inventory and creating opportunities for existing homeowners to move up.

Challenges Facing First-Time Buyers

Affordability: Rising home prices and interest rates have made it harder for first-time buyers to afford homes, especially in a market with limited inventory.

Mortgage Rates: Higher rates mean higher monthly payments, limiting the purchasing power of many buyers.

Inventory Shortage: A lack of affordable homes exacerbates the challenges for first-time buyers, who struggle to find properties within their budget.

Opportunities for Sellers and Investors

Targeted Marketing: Sellers can appeal to first-time buyers by offering affordable pricing and highlighting financing options like government programs or down payment assistance.

Investing in Starter Homes: Investors focusing on affordable homes stand to benefit from the ongoing demand in this segment.

Flexible Financing Options: Rent-to-own models or creative financing can attract buyers who need more flexibility in a challenging market.

Empowering First-Time Buyers

Despite the hurdles, first-time buyers have opportunities to succeed by exploring financing options, government programs, and budgeting tools. Sellers and investors who provide guidance and tailored solutions will build lasting relationships with this important group, contributing to a balanced and thriving housing market.

Need Expert Guidance?

Navigating the complexities of the housing market can be daunting, but you don’t have to do it alone. The Justiz League Real Estate Team is here to guide you every step of the way, whether you’re a first-time homebuyer, a seller, or an investor. Our dedicated professionals are committed to helping you achieve your real estate goals in 2025 and beyond. Let us help you turn your homeownership dreams into reality